Summary

- Customer Portfolio: What Is It Exactly?

- Why Is a Customer Portfolio So Important?

- 4 Tips to Develop Your Customer Portfolio

- How to Manage Your Customer Portfolio?

- How to Evaluate Your Customer Portfolio?

- What KPIs to Track for Evaluating Your Customer Portfolio?

- What Tools to Use for Tracking and Evaluating Your Customer Portfolio?

- Key Takeaways on Customer Portfolios 💡

- Customer Portfolio FAQ

In this article, we will demonstrate the vital importance of customer portfolio management for your business success and guide you on how to manage it effectively. We will also share four strategic tips to grow and enhance your customer portfolio.

Whether you are an entrepreneur, a sales professional, or a marketing manager, this article is packed with practical information to help you boost your results.

Customer Portfolio: What Is It Exactly?

A customer portfolio represents the totality of a company's clients, including current customers and potential clients such as leads, prospects, or suspects. It encompasses crucial information about each client, such as contact details, purchase history, needs, and preferences.

This tool is essential for the company as it allows precise adaptation of its offer, communication, and after-sales service to each client profile, ensuring their satisfaction and loyalty.

With a well-maintained and regularly updated customer portfolio, a company can easily identify sales opportunities, recognize clients requiring special attention, and develop tailored loyalty strategies.

In short, the customer portfolio is a commercial performance driver and a strategic growth vector for the company.

Customer portfolio management can be entrusted to a single salesperson or shared among several based on precise segmentation criteria such as industry, company size, contract type, seniority, among others.

This strategic segmentation allows for a fine understanding of the expectations of each customer category and the proposal of tailor-made solutions.

Develop your customer portfolio efficiently and effectively with the support of VoIP software.

Why Is a Customer Portfolio So Important?

Creating a customer portfolio is fundamental to the progress of your professional activity. This approach allows you to better understand, retain, and expand your customer base.

The benefits of a customer portfolio are numerous:

- Reduced Prospecting Costs: It lowers expenses related to prospecting and acquiring new clients, as it is generally more economical and simpler to resell to existing customers.

- Increased Loyalty: It fosters loyalty by offering personalised experiences that specifically meet each individual's needs, thus increasing their trust, satisfaction, and loyalty to your brand. Additionally, it encourages recommendations of your business within their network.

- Revenue Growth: It boosts your revenue by offering current clients complementary or cross-sales, which increases the average order value and leverages the potential of the most profitable customers.

- Performance Evaluation: It allows you to evaluate and improve your commercial performance through the analysis of information collected in your customer portfolio, helping to detect strengths and areas for improvement in your strategy to better guide your actions.

4 Tips to Develop Your Customer Portfolio

Understanding the importance of a customer portfolio is crucial for energising your business. However, if developing it seems perplexing, stay calm. Here are four practical tips not only to expand your customer base but also to boost your revenue.

Tip 1: Leverage Social Media

Social platforms are a fantastic springboard to attract new clients while retaining existing ones. Share engaging content, interact with your audience, gather their opinions, and consider targeted advertising campaigns. This is an effective way to improve your brand image, increase website traffic, and benefit from word-of-mouth.

Tip 2: Retain Your Customers

Retaining an existing customer is often more economical than attracting a new one. Ensure you offer them an exceptional experience, provide personalised offers, and establish a loyalty or referral system. Using a Customer Relationship Management (CRM) system can also help maintain this connection, optimising satisfaction and loyalty.

Tip 3: Maximise Networking Opportunities

Professional events are a perfect opportunity to expand your network, gain visibility, and win new clients. Get involved in trade shows, conferences, workshops, or networking meetings. Organising your events, such as webinars, training sessions, or demos, can also highlight your expertise, build connections, and spark interest.

Tip 4: Segment Your Customer Portfolio

Segmenting your clientele involves grouping your clients into segments based on significant criteria such as potential, profitability, or purchasing behaviour. It helps you better understand your clients, offer targeted proposals, and prioritise your commercial efforts. This allows you to focus on the most profitable clients and increase your sales.

By implementing these four tips, you will lay the foundations for a robust customer portfolio and enhanced revenue. Effective management of your customer portfolio will be discussed in the next section.

How to Manage Your Customer Portfolio?

Managing your customer portfolio is essential for developing and ensuring the sustainability of your business. It involves establishing and enriching customer relationships to maximise their value.

But how do you succeed in managing your customer portfolio? Here are five proven strategies:

Strategy 1: Clarify Your Processes

Effective management starts with a precise understanding of your goals, success indicators, and procedures. It is crucial to determine each team member's role and choose the right tools to collect, analyse, and share customer information.

Strategy 2: Focus on Key Accounts

Identify the most valuable clients for your company and give them special attention. Base this on criteria such as revenue, growth potential, loyalty, and customer satisfaction to offer tailored solutions and retain them long-term.

Strategy 3: Be a Trusted Advisor

Instead of being seen as a mere supplier, your clients should view you as a strategic partner. Listen to their needs and expectations, offer relevant advice, and add value to their business. Support them throughout the sales process and beyond.

Strategy 4: Create Dependency Links

Make your clients dependent on your services or products by strengthening their connection. Offer additional services, unique offers, training, or exclusive advantages. Encourage them to subscribe to your newsletter, follow you on social media, or participate in your events.

Strategy 5: Be Proactive

Anticipate market fluctuations, customer expectations, and competitor movements. Regularly assess your strategy's effectiveness and adjust it based on customer feedback. Prepare to quickly adapt your strategy in case of a crisis, loss of a key client, or any unforeseen situation.

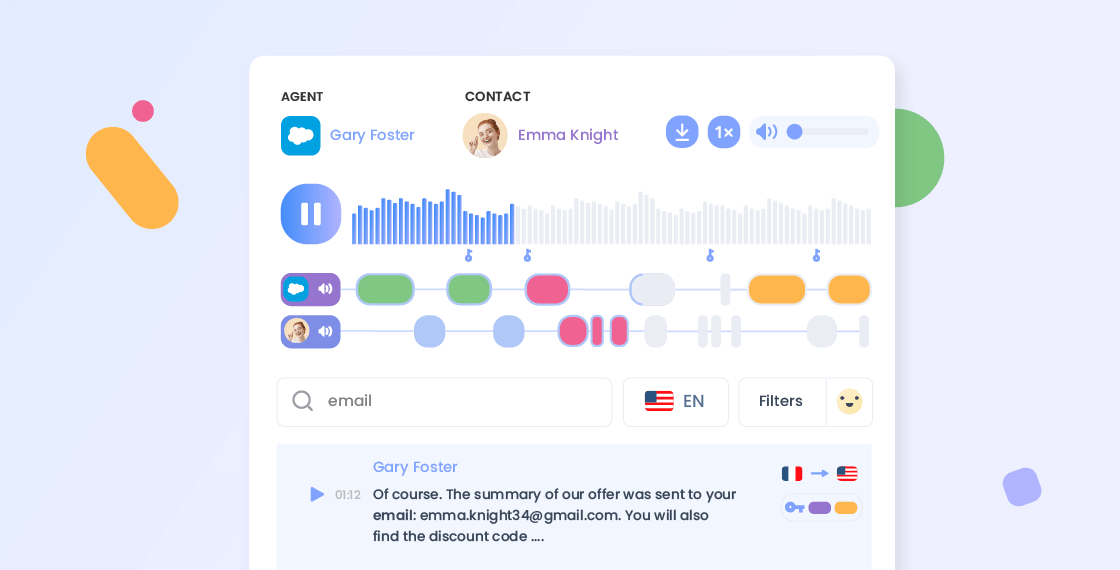

Analytical tools like Empower can assist in this process. These tools can transcribe your exchanges with clients to analyse their quality and guide you. A key moment detection function is also included to help you automatically spot the most relevant parts of each conversation.

This detection is done through the automatic identification of keywords you consider relevant to your business. Discover Empower in action.

How to Evaluate Your Customer Portfolio?

Evaluating the customer portfolio involves measuring the effectiveness and profitability of a company's clientele. This analysis plays a crucial role in adjusting and improving business strategies. You might wonder how to conduct this evaluation effectively. Discover the key steps to achieve this.

4 Steps to Evaluate a Customer Portfolio

1. Customer Segmentation

Classify customers into different categories based on criteria such as company size, industry, purchase volume, etc. This allows for adapting strategies according to the specific needs of each segment.

2. Profitability Analysis

Calculate the profit margin per customer to identify the most profitable ones. Also, evaluate the cost of acquiring and retaining customers to understand the return on investment for each client.

3. Satisfaction and Loyalty Evaluation

Use satisfaction surveys to get direct feedback from your clients. Analyse retention and churn rates to accurately measure customer loyalty.

4. Market Share Analysis

This is a challenging part because it's not always easy to get reliable data on competitors' performance. However, the idea is to compare your sales with those of your competitors to understand your market position.

What KPIs to Track for Evaluating Your Customer Portfolio?

| KPI | Definition | Formula |

|---|---|---|

| Customer Lifetime Value (CLV) | Total value a customer brings to the company throughout the relationship | (Average Purchase Value x Annual Purchase Frequency x Average Customer Lifespan) |

| Customer Acquisition Cost (CAC) | Average cost to acquire a new customer | (Total Marketing and Sales Expenses) Number of New Customers Acquired |

| Customer Retention Rate | Percentage of customers retained over a given period | [(Number of Customers at End of Period - Number of New Customers During the Period) Number of Customers at Start of Period] x 100 |

| Customer Churn Rate | Percentage of customers lost over a given period | (Number of Customers Lost During a Period Total Number of Customers at Start of Period) x 100 |

| Net Promoter Score (NPS) | Measure of customer satisfaction and loyalty based on their willingness to recommend the company | % of Promoters - % of Detractors |

| Average Order Value | Average amount spent per order | Total Revenue Number of Orders |

| Sales Growth Rate | Measures sales growth from one period to another | Sales Growth Rate = [(Current Sales - Previous Sales) Previous Sales] x 100 |

| Conversion Rate | Percentage of prospects converted into customers | Conversion Rate = (Number of Customers Total Number of Prospects) x 100 |

What Tools to Use for Tracking and Evaluating Your Customer Portfolio?

Tracking and evaluating your customer portfolio can be complicated, especially as it grows. To help you, you can skillfully combine essential tools such as your CRM, telephony, follow-up tool, and conversational analysis tool. Here are some examples of tools to enhance your arsenal for broadly tracking your customer portfolio:

Ringover

Our in-house solution offers all the features of an advanced business phone system. It simplifies communication with customers through unlimited calls included, video conferencing, text messages, all integrated into a single application. You will also find a tool for tracking your call campaigns. Ringover integrates perfectly with major CRMs on the market, allowing you to make calls directly from your business software.

Cadence by Ringover

Cadence is a solution developed by Ringover, specifically designed to automate and personalise sales cadences. It allows you to create and identify the most effective prospecting sequences. Designed to assist you in your follow-up efforts, you will find customizable semi-automatic messages, templates for your prospecting emails, and real-time indicators for tracking your opportunities.

Empower by Ringover

Powered by AI technology, Empower by Ringover is a solution designed to empower sales teams by providing easy access to rich and actionable communication data. It is a set of tools integrated into the Ringover solution to enhance productivity and collaboration.

You will find advanced insights and analyses to improve the quality of your customer interactions, detection of the most relevant moments for you, and, of course, transcription and summarization of your calls. These can also be translated into multiple languages with a single click.

Salesforce

Salesforce is a customer relationship management system that offers a wide range of features for sales management, customer service, marketing, and process automation. It enables salespeople to track their customer interactions, manage leads, sales opportunities, contracts, and much more.

Try a Salesforce x Ringover IntegrationHubSpot

HubSpot is a CRM tool that integrates closely with other HubSpot products, providing effective solutions for sales automation and inbound marketing. It is designed to help you attract customers, convert leads, and close sales.

Try a Hubspot x Ringover IntegrationZoho CRM

Zoho CRM is a comprehensive and customizable CRM solution suitable for businesses of all sizes. It allows for capturing leads, automating workflows, engaging customers, and generating detailed reports.

Try a Zoho CRM x Ringover IntegrationPipedrive

Pipedrive is a visually intuitive CRM and sales pipeline tool designed for sales teams. It allows users to effectively manage their sales pipelines and track overall performance.

Try a Pipedrive x Ringover IntegrationMonday.com

Monday.com is a versatile work management platform that can be used for customer relationship management, team collaboration, and project tracking. It offers flexibility to create custom workflows and collaborate in real-time.

Try a Monday.com x Ringover Integration

Each of these tools has its own advantages and may be better suited to specific needs depending on the size of the business, sales prospecting processes, and preferences for interface and functionality. Therefore, it is important to evaluate each tool against your specific customer management needs before making a choice.

Key Takeaways on Customer Portfolios 💡

A customer portfolio is essential for your business as it allows you to better understand your customers, retain them, and increase your revenue.

With the arsenal of tips and tools at your disposal, it's time to take action. Don't put off until tomorrow what you can do today: start enriching, managing, and leveraging your customer portfolio without delay. Positive results will soon follow.

Customer Portfolio FAQ

What is a customer portfolio?

A customer portfolio includes all your current, past, and even potential customers such as leads, prospects, or suspects. It is essential for managing, retaining, and enriching relationships with your customers according to their needs and preferences.

How to build a customer portfolio?

Creating a robust customer portfolio involves initiatives for prospecting and retention. Prospecting aims to discover, contact, and persuade potential customers through tools like professional social networks, referral networks, sponsorship, inbound marketing, and networking events. Retention aims to strengthen relationships with existing customers by improving their satisfaction and loyalty while offering them cross-selling or upselling opportunities. This involves a thorough study of the customer portfolio, segmentation based on each customer's value, personalised communication, exemplary after-sales service, and regular evaluation of customer satisfaction.

How to structure a customer portfolio?

Structuring a customer portfolio involves meticulously analysing the characteristics, behaviour, and value of each customer, then classifying them into homogeneous segments according to criteria adapted to your sector. You must then align your sales strategy and customer interaction based on the specificities of each segment, taking into account their needs, expectations, and potential.

How to track a customer portfolio?

Tracking a customer portfolio requires rigorous organisation of customer information, segmentation according to adapted criteria, personalised communication, and an offer constantly adjusted to customer expectations. Using CRM software can greatly simplify this management by centralising data, automating processes, and measuring results.

Published on July 4, 2024.